How to use Android Pay: Sberbank of Russia

Android Rau is a service that turns your mobile device into a tool for paying for purchases in real outlets or on the Internet. And although this payment system was launched in Russia on May 23, 2022 and has since gained great popularity among the population, new smartphone users often have questions about how to use Android Pay Sberbank, on which devices this technology works, and what is NFC in phone. In this article, we will tell you how to pay for purchases from your smartphone and how to set up this feature.

Android Rau is a service that turns your mobile device into a tool for paying for purchases in real outlets or on the Internet. And although this payment system was launched in Russia on May 23, 2022 and has since gained great popularity among the population, new smartphone users often have questions about how to use Android Pay Sberbank, on which devices this technology works, and what is NFC in phone. In this article, we will tell you how to pay for purchases from your smartphone and how to set up this feature.

Which devices support

Before using contactless payments, you need to make sure that your gadget supports this technology at all. For the service to work, you need a device with OS version 4.4 or later, as well as with a built-in NFC module. If both requirements are met, you can start setting up the service.

NFC module: Near Field Communication or near field communication technology is a special receiver in mobile gadgets. The peculiarity of the new technology lies in its speed and portability.

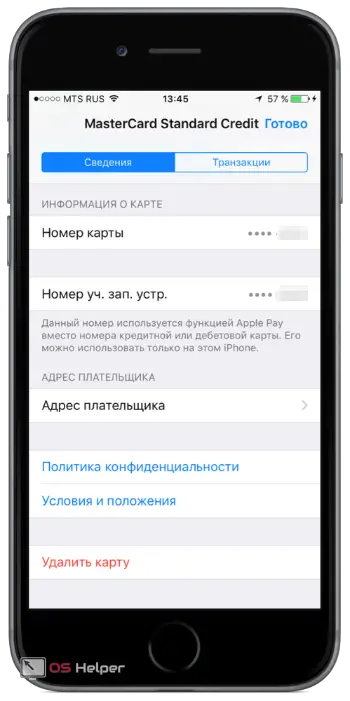

There are two ways to add a plastic card to the Android Pay service: through the payment service utility itself or using the Sberbank Online application. It should be borne in mind that Root-rights or unofficial firmware on the device will not allow you to activate the Android Pay service even with the full technological perfection of the gadget. This is Google's security policy.

Connecting via Android Pay

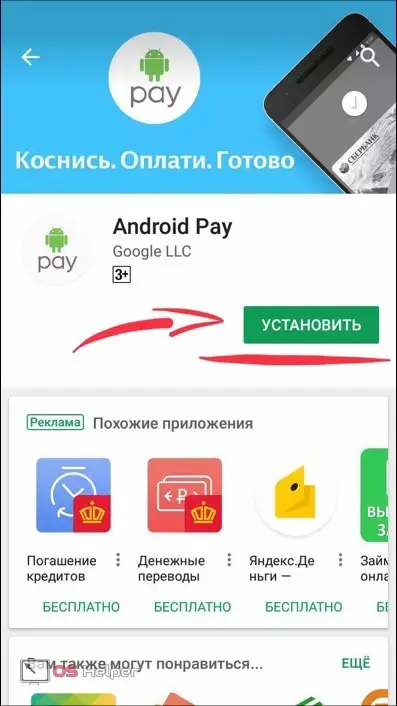

- We go to Google Play and download the official Android Pay application.

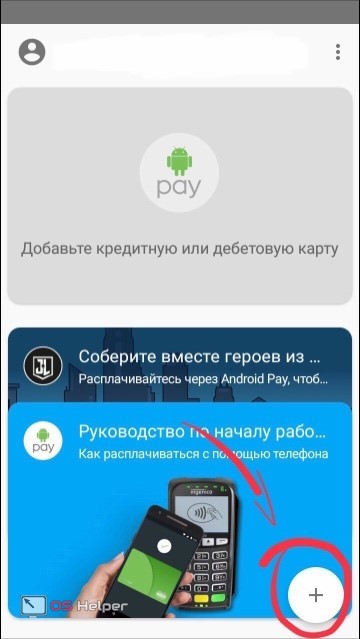

- We go into the application and click on the plus sign in the lower right corner.

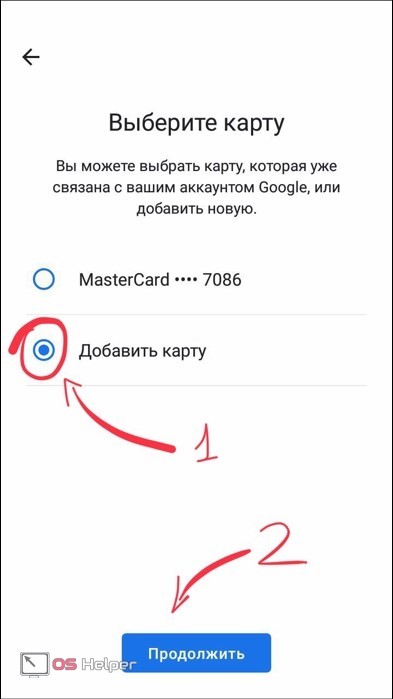

- Click "Add a card", then - "Continue".

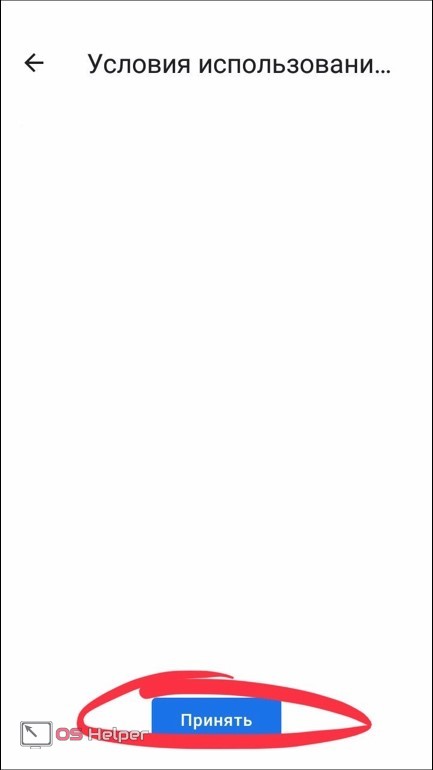

- We enter the card data ourselves or scan the information using a smartphone camera. We accept the terms of use of the payment system.

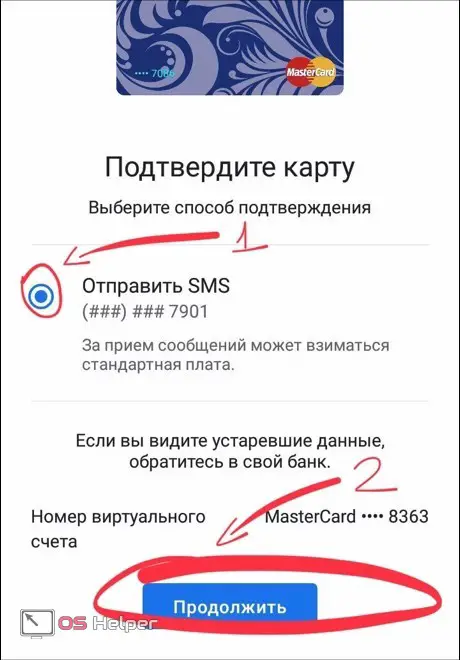

- We confirm the binding using an SMS message.

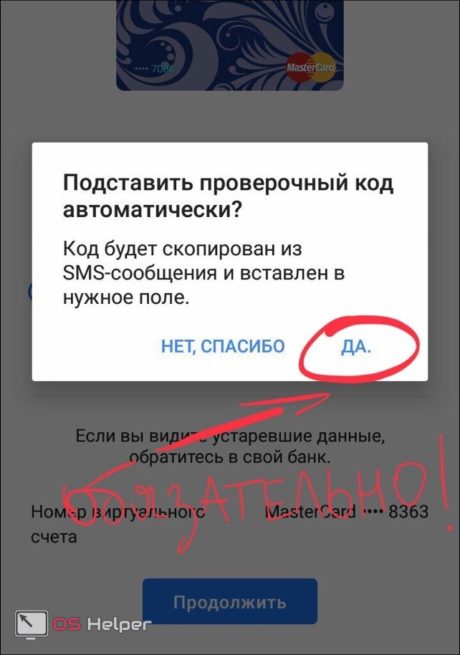

- Enter the received verification code or copy it as in the photo below.

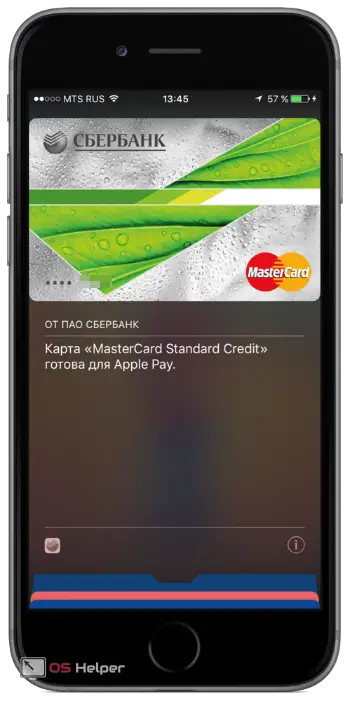

- Now everything is ready! You should also receive an SMS notification about the successful completion of the operation. By the way, you can connect as many bank cards to Android Pay as you like. Please note that at the final stage, 1 ruble may be debited from your personal account, but it will be immediately returned back - this is required to verify the payment card number.

Connection via Sberbank Online

This method is much simpler than the first and will take you less time if the application from Sberbank is already on the device.

See also: How to find out the password from Wi-Fi on Android

Just launch SberbankOnline, select the card you want to register in the payment system, and then click on "Add to Android Pay". Now everything is ready!

Which cards are suitable

The official website of the issuer says that absolutely any cards can be connected to Android Pay, not counting the Maestro. Users of debit cards and credit cards VISA, MIR, Mastercard will be able to access contactless payment technology from Google if their smartphone meets the technical requirements that have already been mentioned earlier.

The MIR map appeared back in 2014, but many people still do not know what it is. MIR is a Russian national payment system created in the context of the possible termination of such international systems as VISA or Maestro on the territory of our country.

If it is not possible to register a plastic card in Android Pay, you should check its compliance with the payment system.

Payment for services

The payment system allows you to make payments both through bank terminals in stores and on websites. In both cases, absolutely no effort will be required of you - paying with a smartphone is much more convenient than with a plastic card.

Availability of contactless payments

When terminals supporting contactless PayPass or PayWave payments were just beginning to appear in Russian stores and cafes, users very often had to be disappointed and still make purchases in the usual way - using a plastic card. By 2022, the situation has become completely different: today it is difficult to find a place where you would not accept a mobile device for payment.

Interesting fact! The number of terminals serviced by Sberbank in Russia is over a million, and all of them support contactless payment technology.

To physically pay for the purchase, the user will need to follow just two simple steps:

- unlock smartphone;

- bring your gadget to the payment terminal.

Everything! After completing these steps, you should see the inscription "Done!", Which means the successful completion of the payment.

When paying with Android Pay for purchases in excess of a thousand rubles, you will be required to enter a pin code at the terminal. Also, if the user connects several cards to the payment system, it will be necessary to assign one of them as the standard one, and then all payments will go through it by default.

Payment through apps and websites

Android Pay transactions are also available in some apps and websites. In the second case, you will have to make purchases only through mobile Google Chrome - alas, other browsers do not support this technology.

Also Read: Recover Contacts on Android

If making an online payment is available, you will see the inscription "Pay with Android Pay", which indicates that the site or application supports transactions using technology from Google. Today, this payment method is available in Lamoda and ASOS online stores, in Uber and Delivery Club services, as well as in many other applications, the list of which is constantly updated.

How to disable

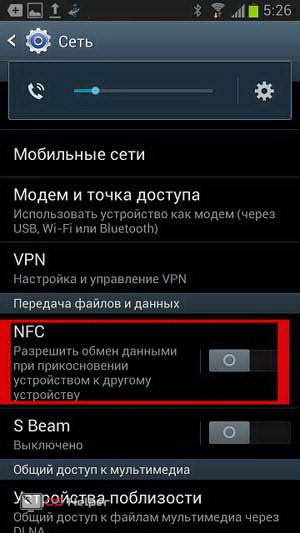

There are always two ways to untie Android Pay from your phone or smart bracelet. The first is to remove the application itself (this is done in exactly the same way as in the case of any other utility), and the second is to suspend the NFC module. To stop this function, you will need:

- Go to Settings.

- Open submenu Wireless networks.

- Find the NFC string and turn off this feature.

The second method is more convenient, because in this way you can always re-enable the service on your mobile device.

Service billing

There is no commission for using Android Pay with a Sberbank card: you can verify this yourself on the company's website.

Where is payment accepted

Today, Android Pay payments are available in retail chains such as Perekrestok, Pyaterochka, Rosneft, M-Video, Burger King, Starbucks — in other words, wherever you are used to shopping.

Differences from Apple Pay

The main difference between Android Pay and Apple Pay is that you can use both the standard Wallet tool and utilities created by other developers to make purchases using the Google payment system. Third-party apps, in order to get into Google Play, are tested for compliance with security and privacy standards, which guarantees the safety of your personal information from unauthorized persons. Apple devices can only install a standard application for making contactless payments, and support for other software is not provided.

Another feature of Android Pay is that when paying for a purchase up to one thousand rubles, the user does not need to confirm this action by entering a password and using a fingerprint, all they need to do is bring the smartphone to the terminal. In Apple Pay (or in Samsung Rau), to complete any payment transaction, you will first have to unlock the gadget. On the one hand, the Google system looks less secure, on the other hand, it is more convenient, and transactions without entering a PIN code can always be challenged at the bank, so the choice is up to the user.

Safety of use

Google guarantees that information about the cards registered in the Wallet does not spread beyond the servers of the developer company. User data is encrypted using SSL technology, and the merchant sees only the cyber-account number during the transaction of means of payment, and not the real information about the card.

Read also: What to do when working with Android System Recovery 3e

Also, when protection on the smartphone is deactivated in the form of entering a password or a biometric scanner, all information from Android Pay will be erased - this way no one will be able to find out your personal data from the gadget screen. In case of loss of a mobile device, the user can always remotely erase bank card information thanks to Android Device Manager for Windows OS.

Advantages and disadvantages of Android Pay

The advantages of using this system compared to making payments in the "classic" way - by bank card - are:

- protection of personal data. No one will be able to find out about your means of payment thanks to password protection or a fingerprint scanner.

- the speed of the payment transaction. The user no longer needs to take out a wallet or a plastic card and waste his time, because the smartphone is always at hand.

- one means of payment instead of several. With Android Pay, you can leave your purse at home - all your cards are stored in Android Wallet at once.

Among the disadvantages of this technology are:

- reducing the battery life of a mobile device. Always-on NFS technology and the active use of Android Pay consume battery power, reducing smartphone battery life. And without a device, you still have to use the “classic” payment method to make a purchase.

- cannot withdraw cash. Unfortunately, no ATM will allow you to withdraw cash with the touch of a mobile device.

So, using Android Pay has a number of advantages over paying with a plastic card, but only until your gadget runs out of power or you need cash. It is also worth noting here that the service works in Russia without any errors and failures.

Summing up

Android Pay - a payment system from Google Corporation - has both positive features and disadvantages, but in any case, using the service will help make your life much easier. Connecting Sberbank cards to a payment instrument from the global IT giant should not cause any difficulties for smartphone users, so go to Google Play and download the application.

Below you can leave comments or feedback on this topic, as well as ask questions that interest you.

Video

For a better understanding of the topic, you can watch this video yourself, which will clearly show you how to use Android Pay with a Sberbank card.